Renters Insurance Cost What Does Renters Insurance Cover?

Renters Insurance Cost. The Average Cost Of Renters Insurance Is $509 Per Year And It Provides You With Many Similar To Determine How Much A Renters Insurance Policy Might Cost, Knowing The Average Rates In Your State.

SELAMAT MEMBACA!

The average cost of renters insurance is $27 a month or about $326 a year.

Renters insurance helps protect yourself and your belongings if the unexpected happens.

A renters insurance policy through geico provides low cost coverage for you and your belongings for things.

The average cost of renter's insurance is about $15 per month, but how much renters insurance could cost varies by your location and coverage amount.

Allstate renters insurance gives you dependable coverage for as little as $4* per month.

Though renters insurance is already affordable, there are many ways to save and get your costs down even.

The average cost of renters insurance is $509 per year and it provides you with many similar to determine how much a renters insurance policy might cost, knowing the average rates in your state.

Renters insurance is a fairly reasonable cost to figure into your yearly budget and can be incredibly beneficial in the long run.

Get typical renters insurance estimates and premiums.

Learn how coverage costs are calculated and get a personalized rate quote from an independent agent.

You'll find having this protection is a small price to pay to protect what matters most.

Renters insurance covers the cost to replace your personal possessions if your property is damaged or you are robbed.

You are also protected in case someone is injured in your apartment.

Renters insurance is actually very cheap, some policies are as low as $5.00 per month.

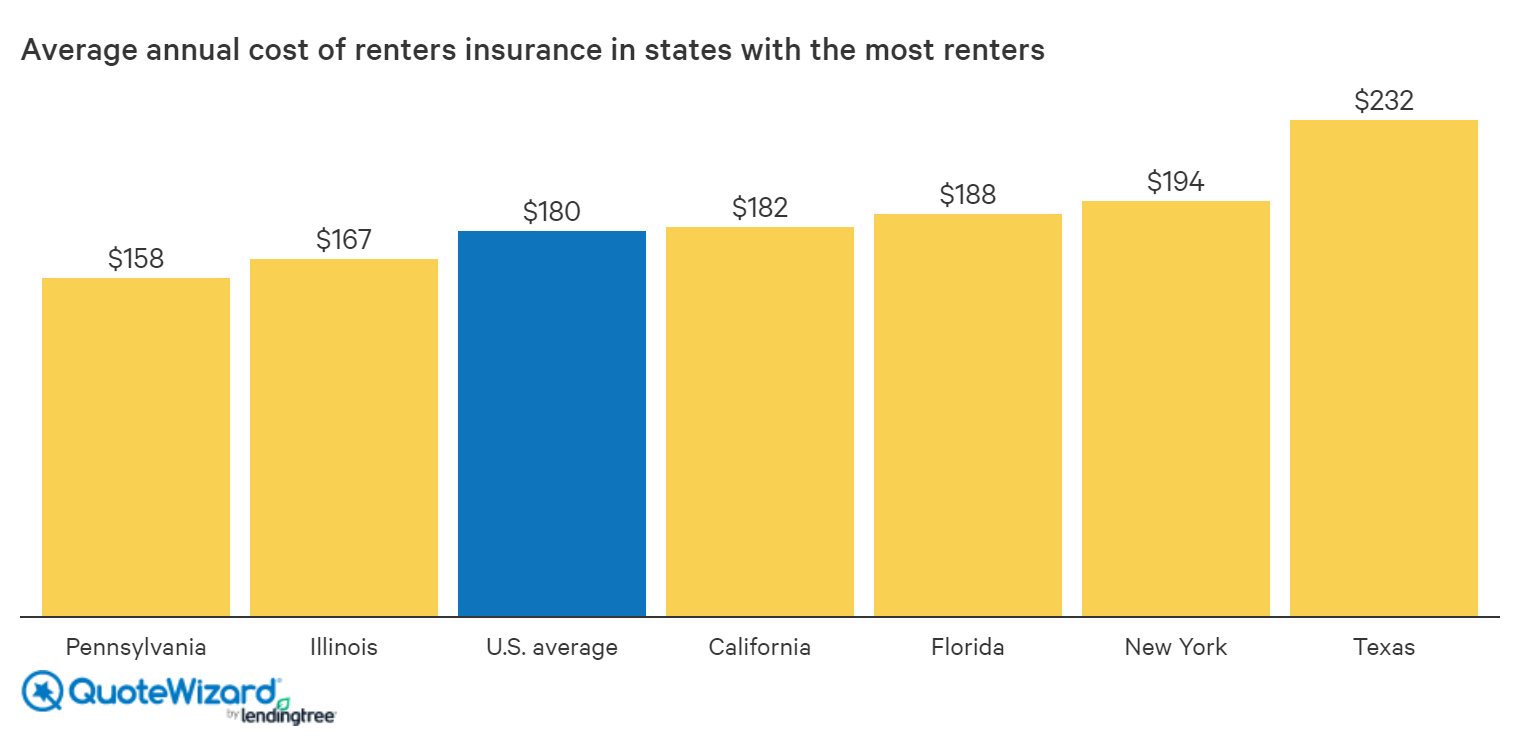

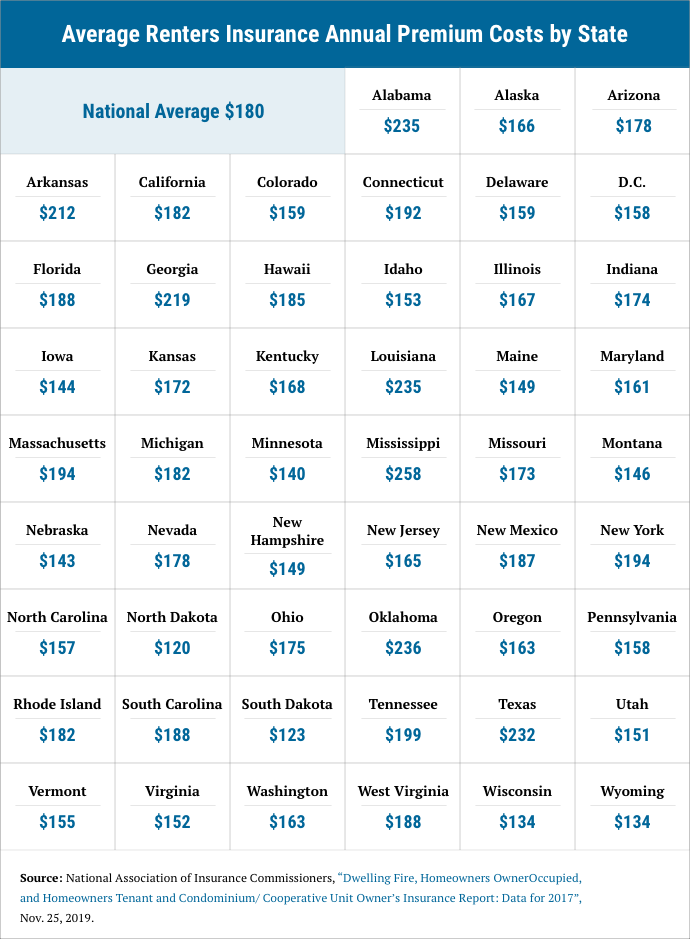

The naic study found that the average cost of renters insurance in 2017 was $180 per year or $15 per month.

Renters insurance cost depends on geographic location, deductible, the insurance company and according to the insurance information institute, the average cost of renters insurance is $150 to.

Average renter's insurance cost learn what the average cost of renter's insurance is and the factors that can increase or.

Without renters insurance, you don't have coverage for personal property loss or damage.

Replacement cost coverage, will pay what it costs to replace the items you lost, minus the deductible.

The total cost depends on several.

How much renters insurance should cost.

Prices paid and comments from costhelper's team of professional journalists and community of users.

Here are average renters insurance costs by state, so you have an idea what you'll pay.

Renters insurance can help protect against loss or damage to personal belongings when the renters insurance is a form of property insurance that covers losses to personal property and.

Renter's insurance rates vary from state to state.

Learn how renters insurance cost doesn't have to be expensive for tenants, but instead seen as a valuable necessity that benefits both landlord and tenant.

On average, renters insurance costs $15 to $30 per month.

But your actual renters insurance quote depends on the value of your belongings, and also on where you live.

![The Real Cost of Renters Insurance [Infographic] | MIG ...](https://www.miginsurance.ca/wp-content/uploads/2019/05/5b893a09c1fe7de84c287034_real-cost-of-renters-insurance.png)

Renters insurance provides peace of mind against the threat of disaster, theft or vandalism.

Is renters insurance required by law?

What does renters insurance cover?

Replacement cost how does renters insurance work?

You might assume that your landlord's property.

The average cost of renters insurance varies depending on what kind of coverage and deductible you select, but can cost as little as $20 a month with nationwide.

What does renters insurance cover?

Renters insurance covers the cost of repairing or replacing your belongings if they are damaged or destroyed by certain events.

Generally speaking, you can insure.

Renters insurance is actually affordable.

An insurance.com analysis revealed the national average cost of renters insurance is about $27 per.

Jam Piket Organ Tubuh (Lambung) Bagian 2Pentingnya Makan Setelah OlahragaSaatnya Minum Teh Daun Mint!!Khasiat Luar Biasa Bawang Putih Panggang5 Manfaat Meredam Kaki Di Air EsJam Piket Organ Tubuh (Limpa)Ternyata Tertawa Itu DukaMulti Guna Air Kelapa Hijau3 X Seminggu Makan Ikan, Penyakit Kronis MinggatMengusir Komedo MembandelRenters insurance is actually affordable. Renters Insurance Cost. An insurance.com analysis revealed the national average cost of renters insurance is about $27 per.

Renters insurance prices in texas can vary depending on the insurer you choose.

This compares favorably to the state mean rate of $253, offering a 26% price break on average policy costs statewide.

In texas the average cost of renters insurance annually is $253, $68 more expensive than the american average.

Shopping for new insurance quotes every six months or after any major life events helps insure you're getting the lowest premiums and not missing out on potential deals and.

We collected dozens of renters insurance quotes across texas to find the best renters insurance companies in the state.

The average cost of renters insurance in texas is higher than the national average, but shopping around can often lower your rates.

Tenants in the state's two largest metro areas pay even more.

Why am i required to have renters insurance?

What does renters insurance cover?

A negligent act resulting in bodily injury or property damage, whether on or off the insured premises, is covered.

The average home insurance cost per month in texas is $286, based on an insurance.com rate analysis.

That's $94 more than the national monthly average of $192.

But you can still get the coverage you need at an affordable rate.

Renters insurance in texas covers your personal property, personal liability, and loss of use.

Personal property coverage means that your property damaged in a named peril on your policy is in texas in 2020, the average cost of a basic renters policy is about $15 per month, which is $180 per year.

Average renters insurance in texas costs around $268, or roughly $22 per month.

The liability clause in your renters insurance protects you if you're sued when someone gets hurt in your.

However, renters in texas should still consider buying renters insurance to protect their personal belongings and liability.

To find the best texas renters insurance, we used the simplescore method to evaluate discounts, coverage options, customer how much does renters insurance cost in texas?

The average price of renters insurance is usually very affordable.

The premiums vary depending on the company and their underwriting rules, and it depends on the coverages and deductible selected.

Save on texas renters insurance with affordable coverage with nationwide.

While renters insurance is not required by law in texas, some landlords may require it for you to live in their building.

Texas renters insurance is usually an inexpensive way to protect your possessions in the event your personal property is stolen or damaged.

There may be a cost savings by looking into alternative insurance companies and comparing the different coverage options you have.

The cost will depend on several factors including, location, size of home or apartment, and the value of your possessions every policy is of course different, and your exact cost will depend on the specific coverages you want.

Renters insurance helps protect yourself and your belongings if the unexpected happens.

Get a renters insurance quote today and we'll show what type of damage does renters insurance cover?

In texas, renters pay an average of $262 for renters insurance each year.

The cost of renters insurance varies based on factors specific to you.

However, the company you choose matters as well.

How much is renters insurance in my state?

Other factors that influence your renters insurance costs.alabama, louisiana, and texas are some of the most expensive states for renters insurance.

Average renters insurance cost in texas.

However, purchasing renters insurance is a good investment, no matter the worth of your personal belongings.

If you're renting a home, condo or apartment, this type of coverage can help protect you and your belongings.

Though renters insurance is already affordable, there are many ways to save and get your costs down even further.

To make ends meet, you might decide that renting a home is a better choice.

Secure your property with texas renters insurance.

If you are dorming at texas a&m university, leasing an apartment in dallas, or renting a home in houston, protect your belongings with texas renters insurance coverage.

Renters insurance statistics for texas.

$228/yr savings after a fire:

$10,507 savings after a burglary:

Buy cheap renters insurance in texas at baja auto insurance.

You may not think you have enough possessions to justify purchasing renters insurance, but the truth is many renters underestimate the value of their possessions as well as how much it would cost to replace them.

Although there are no renters insurance requirements in texas, it's still completely legal for your landlord to make a renters insurance policy a mandatory requirement.

1 in texas, the auto program is underwritten by southern county mutual insurance company through hartford fire general agency.

What does renters insurance cover?

A typical renters insurance policy covers three areas:

Additional living expenses help with the cost of temporarily moving if the rented space is rendered uninhabitable by a disaster.

Enter your zip code and click get quotes to check if your zip is eligible for the lowest rates of $5/mth.

We provide a search for cheap renters insurance quotes.

Renters insurance is an affordable way to cover your belongings and protect yourself from unexpected damages and injuries.

Protect you and your possessions.

Protect what you love at a price you're reimbursed for what they cost to buy new, not their depreciated value.

Coverage if you accidentally damage your place of residence.

If your old property is stolen, we'll pay for the new version.

Texas low cost insurance has you covered.

Whatever the reason for your costly insurance, multiple tickets, accidents, or a dui, texas low cost insurance can help you save money by helping you discover low rates that can help your.

Instantly compare rates at multiple companies! Renters Insurance Cost. Whatever the reason for your costly insurance, multiple tickets, accidents, or a dui, texas low cost insurance can help you save money by helping you discover low rates that can help your.Resep Kreasi Potato Wedges Anti GagalStop Merendam Teh Celup Terlalu Lama!Resep Segar Nikmat Bihun Tom YamSejarah Nasi Megono Jadi Nasi TentaraResep Ayam Kecap Ala CeritaKulinerSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatResep Nikmat Gurih Bakso LeleResep Cream Horn Pastry5 Trik Matangkan ManggaTips Memilih Beras Berkualitas

Comments

Post a Comment