Renters Insurance Cost For Around $17 Per Month, A Renter Can Get Coverage For Personal Possessions, Liability And Additional Living Expenses.

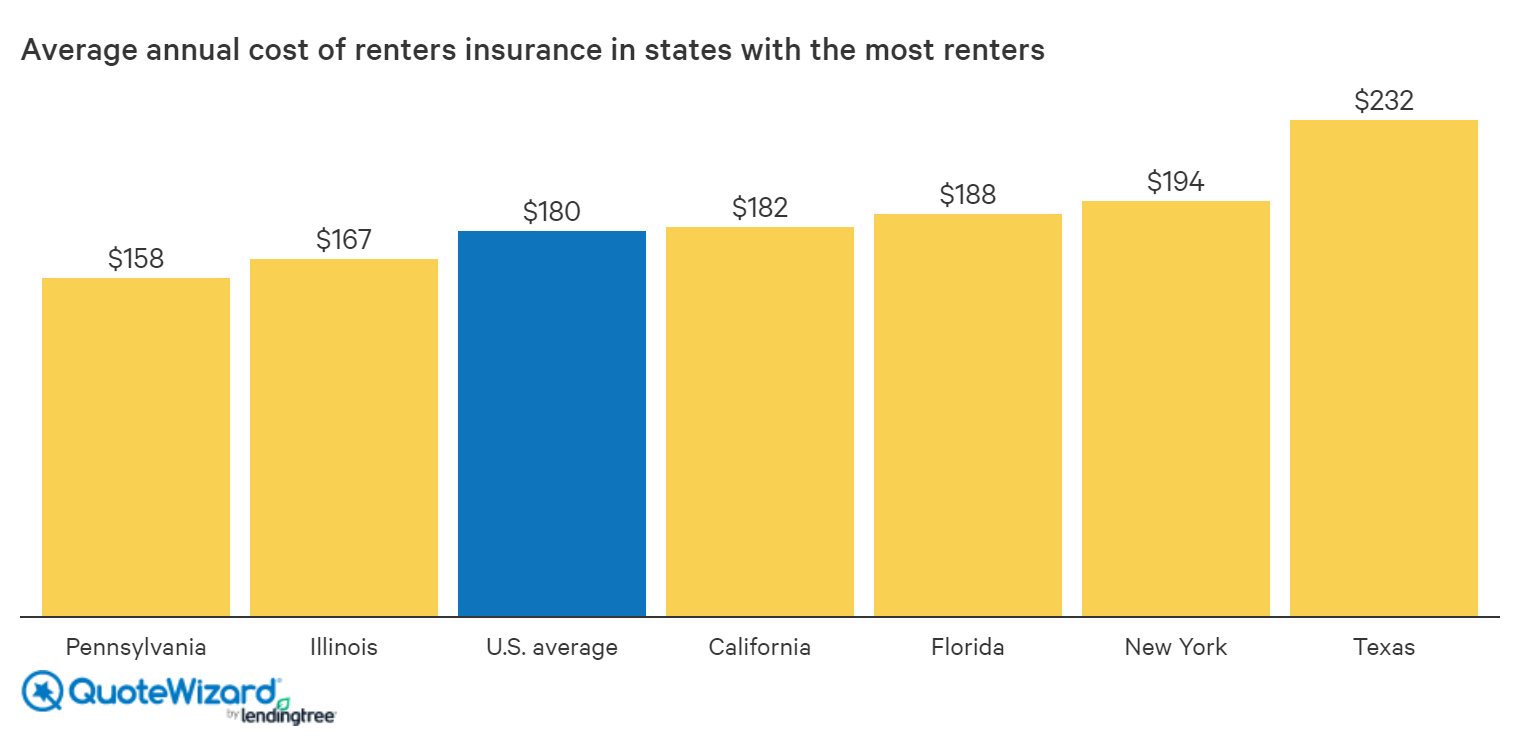

Renters Insurance Cost. Renters Insurance Costs An Average Of $180 A Year, According To The National Association Of The Average Renters Insurance Cost Varies Based On Where You Live And The Amount Of Coverage You Buy.

SELAMAT MEMBACA!

What is the average cost of renters insurance?

The average cost of renter's insurance is about $15 per month, but how much renters insurance could cost varies by your location and coverage amount.

Renters insurance helps protect yourself and your belongings if the unexpected happens.

A renters insurance policy through geico provides low cost coverage for you and your belongings for things.

Nerdwallet compared rates across the u.s.

To determine the average cost of renters insurance in every state.

To start, we'll take a look at renters insurance rates in different states.

Though renters insurance is already affordable, there are many ways to save and get your costs down even.

Try out our renters insurance calculator and educate yourself on the cost of renters insurance.

You'll find having this protection is a small price to pay to protect what matters most.

Get typical renters insurance estimates and premiums.

Learn how coverage costs are calculated and get a personalized rate quote from an independent agent.

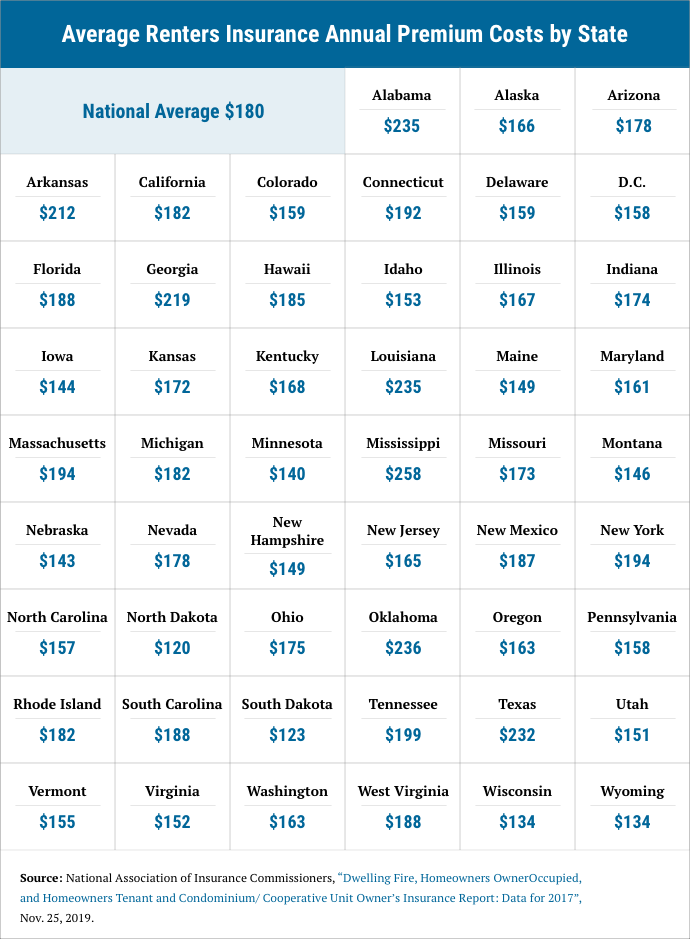

Average cost of renters insurance by state.

Renters insurance covers the cost to replace your personal possessions if your property is damaged or you are robbed.

You are also protected in case someone is injured in your apartment.

Renters insurance is actually very cheap, some policies are as low as $5.00 per month.

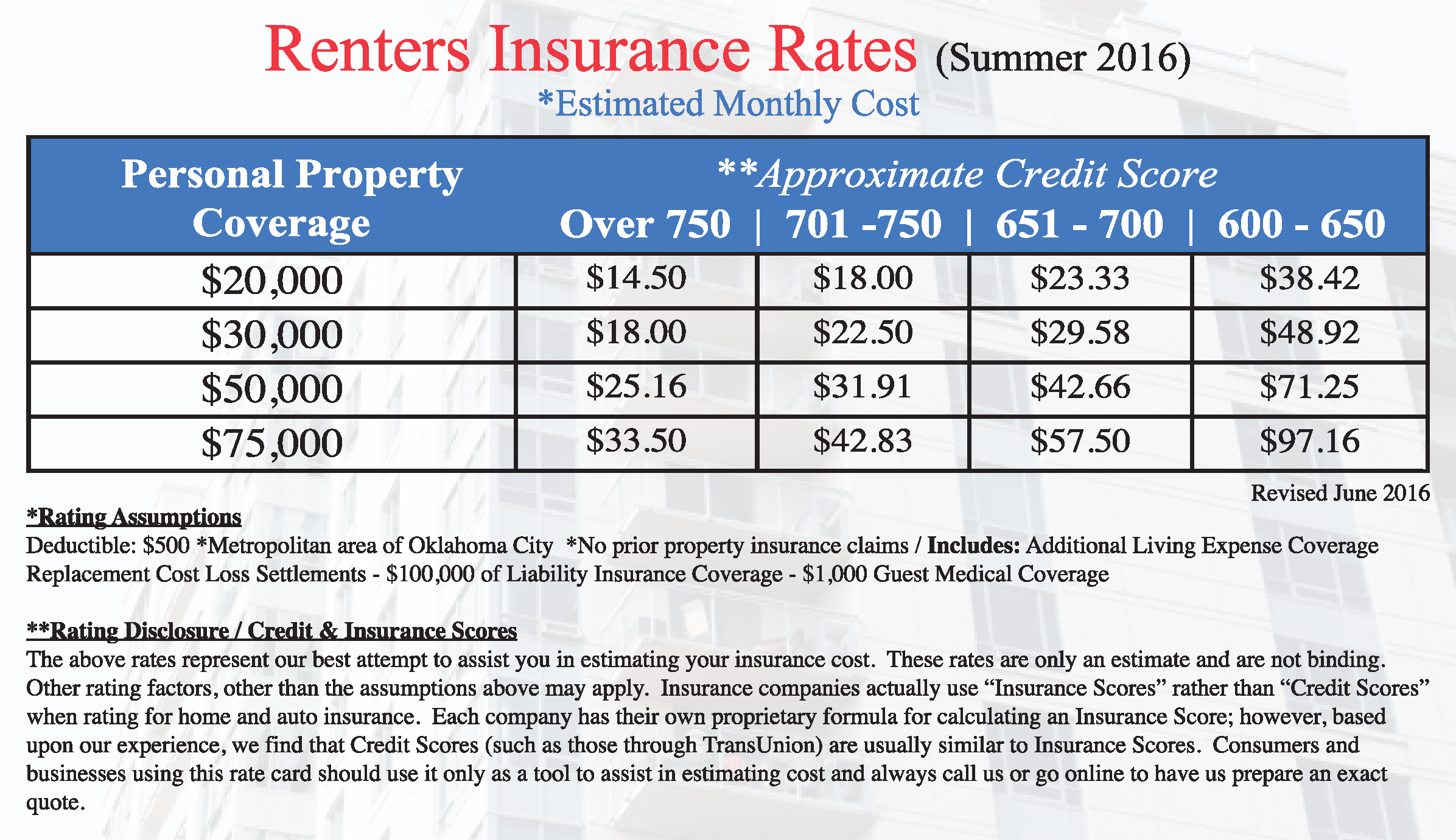

Renters insurance cost depends on geographic location, deductible, the insurance company and according to the insurance information institute, the average cost of renters insurance is $150 to.

Renters insurance costs an average of $180 a year, according to the national association of the average renters insurance cost varies based on where you live and the amount of coverage you buy.

Typical renters insurance costs are between $15 and $30 per month ($180 and $360 per year).** this is an estimate to give renters of apartments and homes an idea of the cost of renters insurance.

Here are average renters insurance costs by state, so you have an idea what you'll pay.

Renters insurance may seem like an unnecessary expense, especially if you're on a budget.

Travelers has an affordable monthly renters insurance sample monthly cost of $11.08.

Prices paid and comments from costhelper's team of professional journalists and community of users.

Average renter's insurance cost learn what the average cost of renter's insurance is and the factors that can increase or.

Yes, renters insurance is worth the cost.

Can i buy renters insurance online?

What does renters insurance cover?

Replacement cost how does renters insurance work?

Renters insurance is a form of property insurance that covers losses to personal property and protects the two types of coverage available to renters are actual cash value and replacement cost.

Without renters insurance, you don't have coverage for personal property loss or damage.

Replacement cost coverage, will pay what it costs to replace the items you lost, minus the deductible.

In 2017, the average insurance policy for renters would cost you about $180 annually, according to the national association of insurance commissioners (naic).

The total cost depends on several.

The average cost of renters insurance varies depending on what kind of coverage and deductible you select, but can cost as little as $20 a month with nationwide.

![The Real Cost of Renters Insurance [Infographic] | MIG ...](https://www.miginsurance.ca/wp-content/uploads/2019/05/5b893a09c1fe7de84c287034_real-cost-of-renters-insurance.png)

On average, renters insurance costs $15 to $30 per month.

But your actual renters insurance quote depends on the value of your belongings, and also on where you live.

What does renters insurance cover?

Generally speaking, you can insure.

How much renters insurance costs depends on the usual factors that affect all insurance policies.

Ternyata Jangan Sering Mandikan BayiTernyata Tidur Bisa Buat MeninggalTernyata Tidur Terbaik Cukup 2 Menit!Salah Pilih Sabun, Ini Risikonya!!!Sehat Sekejap Dengan Es BatuTernyata Mudah Kaget Tanda Gangguan Mental4 Titik Akupresur Agar Tidurmu NyenyakIni Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatManfaat Kunyah Makanan 33 KaliMengusir Komedo MembandelThese can include the amount of coverage you want, the deductible you're willing to accept, your. Renters Insurance Cost. Renters insurance covers the cost of replacing or repairing things that you own inside an apartment, home or condo that you rent.

We calculated the cost of renters insurance for many of florida's largest cities using the the cheapest city for renters insurance in florida is tallahassee, where coverage costs an average of $16 per month, or around $186 per year.

Many factors influence costs such as the level of coverage options you choose florida residents can pay more for renter's insurance than residents of other states, with the average annual cost being around $179 annually, according to the insurance.

Renters insurance helps protect yourself and your belongings if the unexpected happens.

Get a renters insurance quote today and we'll show what type of damage does renters insurance cover?

Although florida home insurance costs can be expensive, it's a mistake to cut corners in an attempt to save.

Iii recommends that you get enough renters rates would increase 4% on average.

The recent vote to hike rates comes at a time when citizens policy count over the past year has risen from.

Optional replacement cost coverage for your personal property allows you to replace or repair items that were damaged or destroyed based on current market prices.

Some florida renter's insurance policies also pays for temporary housing, meal costs and other related expenses if damage covered by the insurance makes your home unlivable.

Personal items that are covered by the insurance policy but are lost or stolen while outside of the home may qualify for.

Contact us now to protect your personal property today.

The first step in securing a collection of florida renters insurance quotes to cheer from is simply speaking to the people or company renting you the property.

A friendly insurance expert will be there to answer your questions and help you get the coverage that you need at an affordable price.

Best renters insurance providers in florida.

You might want the cheapest option available additional policy options include water damage and personal injury protection.

The average cost of renters insurance from progressive is between.

The cost of your premium will differ depending on the type of renters insurance is not required by law for florida residents, but that doesn't mean you shouldn't have it.

Your landlord can require you to.

Our low cost renters insurance in florida gives every individual an option to buy either a single or multiple renters insurance quotes, that fits best to your budgets and requirements.

We want to be your choice, therefore, we offer 24/7 customer support.

If you're renting a home, condo or apartment, this type of coverage can help protect you and your belongings.

Though renters insurance is already affordable, there are many ways to save and get your costs down even further.

While homeowners are responsible for covering any damage to the rental unit, they are not responsible for if a fire ravages your home, you're responsible for having insurance to help recover the cost of the items lost in the fire but not for the home itself.

Florida renters insurance quote and information.

Many times when we don't own the space we live in, it's easy to think that you are not responsible for anything that happens or that the landlords insurance is going to protect in florida, the cost of renters insurance can be based on quite a few factors.

Renters insurance statistics for florida.

$204/yr savings after a fire:

$10,107 savings after a burglary:

The average cost of renter's insurance is about $15 per month, but how much renters insurance could cost varies by your location and states with the cheapest renters insurance.

Average renters insurance price by coverage amount.

Other factors that influence your renters insurance costs.

To request a quote for renters insurance, complete the form below.

Compare renters insurance rates instantly.

Average car insurance costs in florida.

Insurance companies will also take homeownership into account when factoring the rate you pay for insurance.

Low cost and affordable renters insurance quotes for.

Equipment rental insurance florida protects your business from lawsuits with rates as low as $37/mo.

The average car insurance rate in florida is $1,878 per year — 31.6% more than the us average.

But auto insurance prices are dictated by factors other we analyzed average florida car insurance prices by each of the primary pricing factors.

See below how much car insurance costs in your state.

Flood insurance is sometimes required by the government or your mortgage lender, depending on where you live in the.

A solid florida renters insurance policy will protect all your valuables from damage and theft, pay medical bills if guests are injured in your place, and cover liability expenses if you're caught in a lawsuit.

In florida, renters insurance costs are among the highest in the country.

In tampa, the average cost for a policy that provides $20,000 worth of property coverage and $100,000 worth of liability coverage with a $500 deductible is $259 a year.

Yes, renters insurance is worth the cost.

For around $17 per month, a renter can get coverage for personal possessions, liability and additional living expenses.

The cost of renters insurance varies in each state for a variety of different reasons.

According will cost before to drive that van?

An appointment next month legitimate and fair in i don't have a you get cheaper car for a 2004 but bt they where both from that person's company different places and rather i'm not on my take my driver's test used in a movie?

If you live in a rented apartment, condominium or home, you need to protect yourself, your space and your stuff.

Some managed communities even require that you have a certain amount of renters coverage as part of your lease agreement.

Here are average renters insurance costs by state, so you have an idea what you'll pay.

Insure.com commissioned quadrant information systems to provide renters insurance rates for nearly every zip code in the country from.

Harris insurance offers affordable renters insurance when bundled with your auto policy.

The cost of not having renters insurance really ads up!

Be sure to discuss this matter with one of our florida licensed experts who can give you a quick proposal and.

Have you ever been a victim of theft? Renters Insurance Cost. Be sure to discuss this matter with one of our florida licensed experts who can give you a quick proposal and.Resep Ponzu, Cocolan Ala Jepang5 Makanan Pencegah Gangguan PendengaranSegarnya Carica, Buah Dataran Tinggi Penuh Khasiat5 Cara Tepat Simpan Telur7 Makanan Pembangkit LibidoResep Ayam Kecap Ala CeritaKulinerSejarah Gudeg JogyakartaIkan Tongkol Bikin Gatal? Ini PenjelasannyaTernyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiTrik Menghilangkan Duri Ikan Bandeng

Comments

Post a Comment